The new Oculus Rift S and Valve Index headsets that have most recently joined the ranks of the VR incumbents have already started to take noticeable market share, according the Valve’s monthly computer hardware survey.

The survey collects information about the system configuration of the computers and VR Headsets that are accessing the Steam Store. This check happens each time a user logs in and fires up a game title.

This means the type and configuration of your gaming PC is recorded and logged by Steam to fill out the data for this survey each month.

Steam has been collection data on VR Headset for a while. This hardware survey is publicly available through the steam powered web portal. Valve states the data collected is anonymous and that it is used for technology investment decisions.

“Steam conducts a monthly survey to collect data about what kinds of computer hardware and software our customers are using. Participation in the survey is optional, and anonymous. The information gathered is incredibly helpful to us as we make decisions about what kinds of technology investments to make and products to offer.”

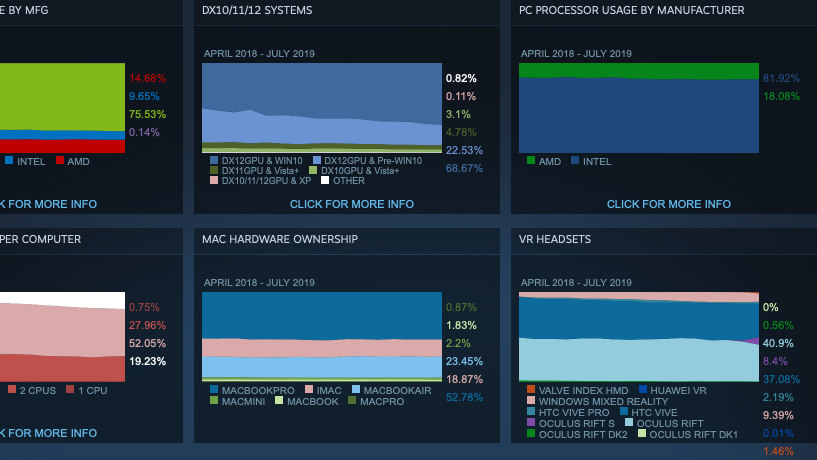

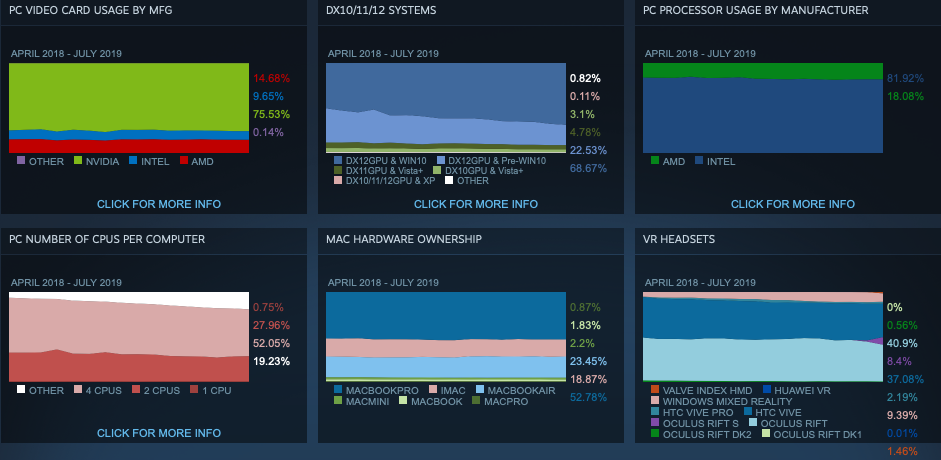

The hardware survey is organized as a dashboard with information about GPU adoption, Graphics Engines, PC Processors by manufacturer, CPU Cores per PC, Mac Hardware ownership breakdown, and – the newest category – VR Headsets.

The dashboard is mostly pretty basic to to look at, with the charts not reflecting any significant visual shifts in technology adoption over time. But, a closer look there are clear trends that the data presents that do seem helpful for game developers hardware developers as along with the benefit Valve states they receive from collecting and analyzing the data.

Some notable and significant trends that stand out in the Valve July hardware survey is the adoption of “other” number of CPU cores – indicating that a growing number of CPUs in circulation have more than 4 Cores. This also acts as an indicator to game developers that they can continue working on their CPU-intensive titles. With a great number of CPU cores in circulation, more user customers will have the appropriate hardware to fully enjoy the CPU intensive titles.

The CPU core-count is also significant for the adotion of VR Headsets, since the best VR experiences require a powerful PC with multiple CPU cores as a minimum system requirement.

The more CPU cores, GPU cores, system RAM, and VRAM – all tracked in the survey – the more potential customers a VR Game developer can be confident they are able to market to.

The VR Headset distribution is also quite telling of consumer behavior. VR Headset customers are quite eager to adopt new VR technology as it becomes available.

The Oculus Rift S and the Valve Index have both started off with a significant jump in market share in the first few months they have been available.

The Rift S already accounts for 8.4% of the VR Headset market just a few months after the release. With the Valve index already accounting for 1.46% after less than a full month of product being available.

Surprisingly, the jump in index ownership almost matches the entire marketshare of the equally priced HTC Vive Pro that only accounts for 2.19% market share. The HTC Vive Pro has been available for nearly a year, with a release date of June 2018.

It’s safe to view the VR Headset numbers as a clear indicator of units shipped for PC-tethered headsets. However, these numbers do not account for the Oculus Quest or the Oculus GO. Both headsets are among the most competitively priced headsets and both have proprietary app stores that do not report usage to the Steam Store.

The Oculus Rift and Rift S accounting for nearly 50% of all PC tethered VR Headsets. This data, along with the added volume contribution from the oculus quest and oculus go, it’s safe to conclude that Oculus is the clear market leader in terms of VR headset distribution.